sanfordbrother

sanfordbrother

Understanding Gold IRA Transfers: A Comprehensive Information To Secure Your Retirement

In recent times, the monetary panorama has seen a notable shift in the direction of various investment strategies, significantly within the realm of retirement financial savings. Among these strategies, the Gold Individual Retirement Account (IRA) has gained vital attention as a viable option for diversifying portfolios and safeguarding wealth towards economic uncertainty. This article aims to provide a complete understanding of gold IRA transfers, highlighting the developments in the process, benefits, and key issues for traders trying to safe their retirement with precious metals.

The Rise of Gold IRAs

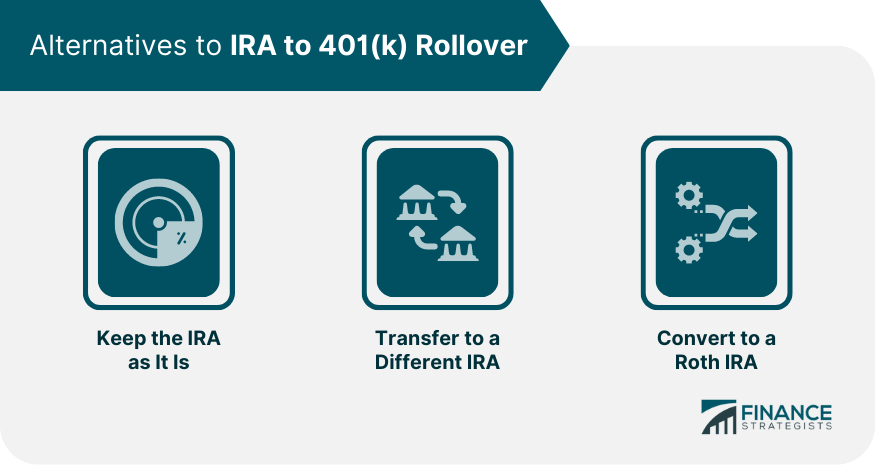

As traditional retirement accounts like 401(k)s and standard IRAs primarily focus on stocks, bonds, and mutual funds, investors have more and more turned to gold IRAs as a hedge in opposition to inflation and market volatility. Gold has been a retailer of value for centuries, and its intrinsic worth tends to stay stable, making it an attractive possibility for retirement savings.

With the appearance of digital platforms and regulatory developments, the strategy of transferring present retirement accounts into gold IRAs has develop into extra streamlined and accessible. This evolution is essential for traders looking for to diversify their retirement portfolios with tangible property.

The Gold IRA Transfer Course of

The transfer course of for a gold IRA involves several key steps, which have been simplified by latest advancements in monetary technology and regulatory frameworks. Here’s a breakdown of the process:

- Select a Custodian: The first step in transferring to a gold IRA is choosing a qualified custodian. Custodians are monetary institutions that manage IRA accounts and guarantee compliance with IRS regulations. Current advancements have led to the emergence of numerous respected custodians specializing in valuable metals, offering investors with a range of choices.

- Open a Gold IRA Account: As soon as a custodian is chosen, the investor should open a gold IRA account. This process usually includes filling out an application and offering needed identification paperwork. Many custodians now provide online account setup, making it convenient and efficient.

- Provoke the Transfer: Traders can initiate the switch of funds from their current retirement accounts (such as a conventional IRA or 401(okay)) to the brand new gold IRA. This is often executed by a direct transfer, the place the funds are moved straight from one account to a different with out the investor taking possession of the cash. This method is crucial as it avoids tax penalties and maintains the tax-deferred status of the retirement funds.

- Select Eligible Precious Metals: After the funds are transferred, traders can select which eligible treasured metals to purchase for their gold IRA. The IRS has particular tips regarding the types of gold, silver, platinum, and palladium that can be included in an IRA. Latest advancements out there have expanded the vary of obtainable merchandise, together with numerous bullion coins and bars from reputable mints.

- Storage Options: As soon as the treasured metals are purchased, they must be stored in an accepted depository. Custodians typically accomplice with secure storage facilities that meet IRS requirements. Traders can now profit from enhanced safety measures and insurance coverage choices provided by these amenities, guaranteeing their belongings are nicely-protected.

Benefits of Gold IRA Transfers

The latest advancements in the gold IRA transfer process provide numerous advantages to buyers:

- Diversification: By transferring to a gold IRA, traders can diversify their retirement portfolios, reducing reliance on traditional assets. This diversification is crucial in mitigating dangers related to economic downturns.

- Inflation Hedge: Gold has historically been viewed as a hedge in opposition to inflation. As the price of living rises, the value of gold usually increases, providing a safeguard for retirement savings.

- Tax Advantages: Gold IRAs provide the same tax advantages as conventional IRAs. Contributions could also be tax-deductible, and investments develop tax-deferred till withdrawals are made during retirement.

- Tangible Asset: Unlike stocks and bonds, gold is a tangible asset that buyers can physically hold. This characteristic can present peace of thoughts, especially in occasions of financial uncertainty.

Key Considerations

While the advancements in gold IRA transfers current important opportunities, buyers also needs to bear in mind of several key issues:

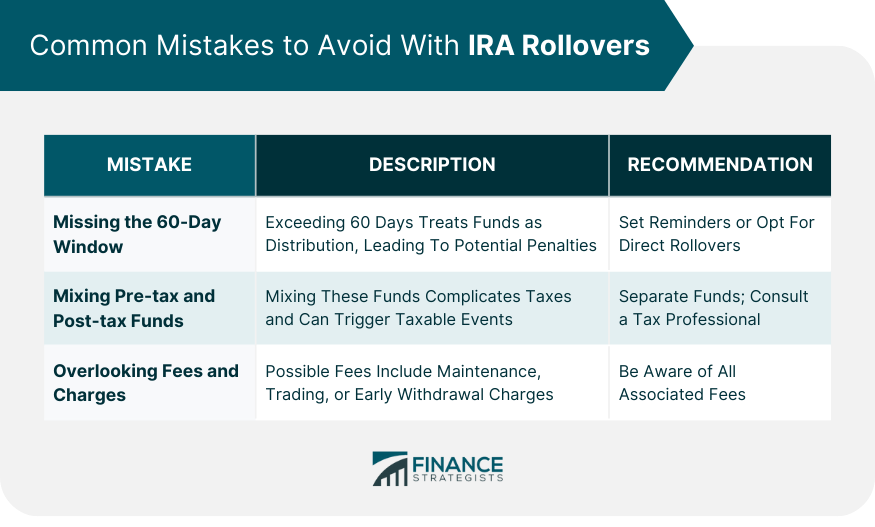

- Fees: Gold IRAs typically include numerous charges, including setup fees, storage charges, and transaction fees. It is essential for traders to grasp these prices and how they could affect overall returns.

- Market Volatility: While gold is generally thought-about a stable funding, its price can nonetheless fluctuate based on market situations. Investors needs to be ready for potential price swings and assess their danger tolerance accordingly.

- Regulatory Compliance: The IRS has specific rules governing gold IRAs, together with the kinds of metals that can be held and storage necessities. Investors must guarantee compliance to keep away from penalties.

- Analysis and Due Diligence: As with any funding, thorough analysis is crucial. If you have any queries concerning where and how to use www.gold-ira.info, you can call us at the webpage. Buyers should consider custodians, storage amenities, and the sorts of treasured metals available to ensure they make knowledgeable choices.

Conclusion

The advancement of gold IRA transfers has made it simpler than ever for buyers to diversify their retirement portfolios with valuable metals. By understanding the process and benefits, in addition to contemplating key factors, individuals can take proactive steps to secure their financial future. As financial uncertainty continues to loom, the appeal of gold IRAs is prone to develop, positioning them as a strategic component of retirement planning within the years to return. Embracing this evolution in investment technique can empower investors to navigate the complexities of retirement financial savings with confidence and foresight.